Estimated Tax Payments

For those who get a paycheck from an employer, withholding sets aside our federal taxes paycheck-by-paycheck – and that keeps us square (mostly) with the IRS. But when you're self-employed, the situation is different – no employer means no withholding.

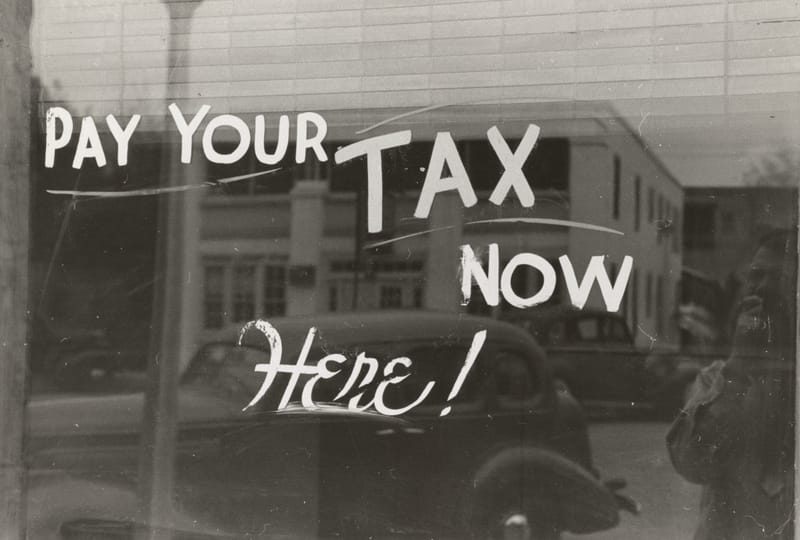

Not having an employer doesn't mean you don't pay taxes, and it doesn't mean you can just wait until you file your taxes to pay the tax you owe. That would mean paying a large amount at once, which usually is not allowed.

That’s where estimated tax payments come in. Think of estimated taxes as self-withholding. Instead of an employer withholding taxes and sending them in on your behalf, you're doing it for yourself.

How do you know if you need to make estimated tax payments? You have to estimate your income and expenses for the year. The IRS says if you expect to owe federal taxes (including your self-employment tax) of $1,000 or more when you do your taxes, you have to make estimated tax payments.

What happens if you don't pay? The IRS imposes an underpayment penalty if you don't set aside enough to satisfy your federal tax bill. While it’s possible to escape the penalty by withholding at least 90 percent of your current year’s tax bill, the closer to 100 percent you can make it, the better.

Estimating Your Tax

The easiest way to start estimating your income taxes is to use last year’s total tax as a guide. Even if you're starting a new business, and your bottom line is expected to be totally different – or even unknown – if you pay this year what you paid last year, the IRS can give you a pass.

So take your total tax from last year – everything withheld for taxes plus any tax you owed on top of that – and divide it by four. That’s what you should pay every quarter this year. If you make less than that this year, you’ll get a refund and a chance to tweak your payments for next year. If you make more, you’ll owe tax only on the income above what you made last year.

This is the easiest way to determine your estimated tax starting point and the safest if your income increases every year.

Now, how to pay? See the IRS' Form 1040-ES, which has all the details, including calculation instructions and payment vouchers.

Report your estimated tax payments to Tax Office & Associates™ and we will enter them on your Form 1040-ES – Estimated Taxes.